Achieving financial success is not reserved for those lucky enough to have the “Midas touch” or who are “good with money.” That is a myth and believing it can keep you from realizing your financial potential.

The truth is that financial success can be learned. There are a lot of financial principles and strategies out there that you can use to improve your financial condition. But making sense of it all and coming up with a coherent plan to improve your financial life can be a bit overwhelming.

So I decided to look back at my personal finance experiences (wins and losses) and try to figure out what worked and what didn’t.

I distilled it all down into five pillars of personal finance. These are the key areas that you need to successfully navigate if you want financial success. We are going to cover each of the five pillars in detail, but here’s a preview:

The Five Pillars of Personal Finance Are:

- Prioritize Your Finances.

- Control Your Spending.

- Reduce Your Debt.

- Stabilize and Maximize Your Income.

- Grow Your Assets.

This post may contain affiliate links. If you click on a link and complete a transaction, I may make a small commission at no extra cost to you.

Pillar One: Prioritize Your Finances

The first pillar of personal finance is prioritizing your finances. There are many areas of life that compete for your time and attention. Your health, family, friendships, religion (if you practice) all play a role in how you define happiness and success.

For some, money does not rank very highly, but if you are here and reading this, you obviously care about your financial situation.

So how do you prioritize your finances? Just wanting to do it is not enough. It boils down to two things: (i) commit to learning how to manage your finances and (ii) stubbornly follow through on what you learned.

You’re here, so you’ve got the commitment to learn. And we’re going to cover the stuff you need to know.

But we’re also going to give you tips on how to execute the personal finance principles we cover, so you can actually see some meaningful improvement in your financial life.

So without further delay, let’s get into it!

Pillar Two: Control Your Spending

Spend less than your earn. It’s obvious, right. But if you were to ask me to reduce personal finance down to its most important principle, this would be it.

You will get nowhere if you can’t get this right. If you earn more than you spend, everything falls into place. You will have money left to save or invest for the future. This will create a sense of security and satisfaction.

And as your wealth grows, you can treat yourself to something nice without guilt. It’s a fine place to be.

But if you spend more than you earn, everything starts to fall apart. Your debts will grow month by month, your insecurities will start to mount, and you will begin to feel like there’s no way out.

But controlling your spending is easier said than done. First, we are bombarded with ads. The average person is exposed to 5,000 ads per day (and this is in 2007, imagine what it is today).

Social media can also be a negative influence when we are trying to spend responsibly. This University of Chicago essay discusses how social media can give the impression that everyone else is going on exotic vacations and generally living the high life.

I think everyone knows that social media creates a false sense of reality, but it’s hard to ignore.

The Solution:

The key to spending less than you earn is setting a realistic budget and sticking to it. There are a million strategies to do this, including the 50/30/20 rule and others.

Setting a budget is actually pretty easy. The hard part is sticking to it. Fortunately, there are solutions that help us do just that.

There are a host of really useful apps that you can use to set and follow your budget.

Mint is a leader in this space. They have a slick app that connects to all your financial accounts and keeps track of your spending.

They also track your bills and give you alerts so can you pay them on time.

Finally, they have a budgeting application that helps you create a realistic budget based on your spending habits. You can then use their “daily budget tracker” to see how your current spending affects how much money you will have at the end of the month.

It’s a great way to know exactly where you stand in relation to your budget at any point in time.

But if Mint doesn’t work for you, find another tool that’s a better fit. There are a ton of them out there.

Once you have a realistic budget and know real time how you are performing against it, there are no more excuses – it’s just a matter of being disciplined and curbing your spending when you need to.

If you want some more great tips on budgeting, including learning the biggest reasons why budgets fail and how to fix them, check out my article on the topic.

Speaking of spending, let’s turn to its diabolical relative, debt.

Pillar Three: Reduce Your Debt

The third pillar of personal finance is reducing your debt. If you are saddled with a large amount of debt, it’s going to be really hard to gain any traction financially.

You must start chipping away at it.

The most obvious place to start is your high-interest debt. When I think of high interest debt, credit cards immediately come to mind. The average credit card interest rate is 14.65% according to the Federal Reserve.

Compare that against other forms of debt, like student loans (avg. of 5.8%), car loans (avg. of 5.27%), and mortgages (avg. of 3.99%).

As you can see, credit cards are by far the worst offender when it comes to high interest rate debt.

So let’s tackle them first.

How to Reduce Credit Card Debt

To reduce credit card debt, the first thing you need to do is stop adding more balances to your credit cards. Obvious, right? But this is a must.

Next, if you are just paying the minimums on your credit cards, you need to do more than that. You will never pay it down that way. Ok, you will, but it will take a long time (like maybe 30 years)!

So you need to find some extra money out of your budget to tackle this. If you have been spending less than you earn, this should not be a problem. Let’s say you are able to devote $50 per month toward paying down your credit cards.

If you have more than one (the average American apparently has 4), you need to decide which one to pay off first.

There are two schools of thought on how to do this:

The Debt Snowball Method

Using this method, you do the following:

- Apply your extra payment (and anything else you can spare) against the credit card that has the lowest balance. Pay the minimums on the rest.

- Pay that card off and then use your extra payment plus the amount you were paying on the card you just paid off and use it to pay off the credit card with the second lowest balance.

- Rinse and repeat until all credit cards are paid off.

The Debt Avalanche Method

Using this method, you do the following:

- Apply your extra payment against the credit card that has the highest interest rate. Pay the minimums on the rest.

- Pay that off and then use your extra payment plus the amount you were paying on the card you just paid off and use it to pay off the credit card with the second highest interest rate.

- Rinse and repeat until all credit cards are paid off.

If you use the debt avalanche method you will pay your credit card debt faster and spend less money on interest payments. If you use the debt snowball method, you will be less efficient along both of these dimensions.

But some people, including Dave Ramsey, prefer the debt snowball method because they believe that getting a quick psychological boost when you pay off that small credit card balance is important to sustain momentum.

I think either method can work – just pick one that better suits your personality.

How to Reduce Student Loan Debt

I would be ignoring a huge issue for many of you if I did not dedicate a section to reducing student loan debt. It is certainly an issue that profoundly affects many younger people, but they are not the only group that is impacted by student loan debt.

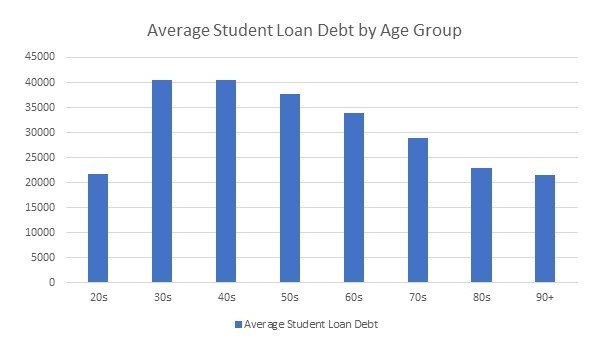

This chart shows student loan balances by age group.

Source: Educationdata.org

Clearly this is an issue that can be relevant to you, regardless of your age.

Why is it important to reduce your student loans?

Maybe it’s not. If you have really low rates, and it is easy for you to make your payments each month, there might be better options than paying down your student loans aggressively. Plus, you may be able to take advantage of tax deductions for interest on student loans.

But if that’s not the case, and you do struggle with student loans, here are some reasons why you should consider paying them down sooner than scheduled.

First, they are usually protected against discharge in bankruptcy. That means that if you fall upon hard times and need to file bankruptcy to get a fresh start, your student loans can continue to anchor you down.

Second, if you want to buy a house, student loan payments may make it more difficult to save for a down payment and will count against your debt to income ratio. Failing to meet this ratio will disqualify you from the mortgage.

This is happening. According to a joint study by the National Association of Realtors and American Student Assistance, 85% of survey respondents said they have not been able to save for a down payment because of their student loans and 52% said that they can’t qualify for a mortgage because of their debt-to-income ratio.

Strategies For Reducing Student Loan Debt

So how do we go about reducing student loan debt? The same principle would apply to paying down student loans as credit cards. You should try to find extra money in your budget to apply against your student loan debt.

If your credit card debt has been cleared away because you successfully implemented the strategy we just covered, then you can certainly apply all of those extra month payments to your student loans.

But you may be able to eliminate your debt faster by refinancing into a lower rate. I did this a few years ago with SoFi and it has really made a difference.

My rate wasn’t that bad to begin with, but they were able to offer me something much better. I kept the payment the same, so it had no impact on my budget, but I have been clearing away the balances much faster.

If you are interested in refinancing, check them out.

Full Disclosure: You will get $10 just for checking out their offer (no hit to your credit either). I will get $10 too. If you refinance your student loan with them, you (and I) will both get an extra $300.

Credit card and student loan debt are two of the main reasons why people struggle with their finances. But by using the strategies we just covered, these debts can become a thing of the past.

If there are other debts you are struggling with or you just want a little more help managing your overall bills, one option you may want to explore is permanently lowering some of your bills.

LowerMyBills.com is a premier, free, online service for consumers to compare low rates on monthly bills and reduce the cost of living. If you are interested in learning more, check them out here.

Now, let’s move on to one of my favorite topics – income. There are some great strategies coming up, so let’s get into it.

Pillar Four: Stabilize and Maximize Your Income

The fourth pillar of personal finance is stabilizing and maximizing your income. And it goes in that order. First, make your income as stable as you can make it. Then you can progress to increasing it.

Ultimately you should branch out beyond your primary source of income and set up multiple income streams.

Stabilize Your Income

If you have a job and that is your only source of income, you need to preserve it as best you can. That means being excellent at it. Well duh, right?

What does being excellent mean? Here’s my short list:

- Be professional

- Be reliable

- Anticipate your boss’ needs

- Expand your skills by taking on projects no one else will (or suggesting projects)

- Be a positive force at work (no gossiping, etc.)

Be Professional:

You should create work product that is impeccable. Make sure you have identified every angle and risk and address them (don’t be lazy on this point).

There is immense satisfaction when you know you covered every single base and your work is rock solid.

Plus it shows your boss how thorough you are and this will make your boss trust you. That’s a good thing.

Be reliable:

This is a no-brainer. You must do what you say you will do and do it on time, every time.

Anticipate your boss’ needs:

If your boss asks you to do something, understand why they want it done. If there is something else that is important to that goal, make sure you do that too (and note that you did it, in a refined and subtle way). This, too, will build trust and put you far above the pack.

Expand your skills:

This one is important, but so many people ignore it. If you want to succeed in your career, you need to expand your expertise and skills. There is not an executive in the world that only knows how to do one small thing in one little area.

You can do this by taking on new projects that will stretch your current skills, changing roles when the chance presents itself, or even creating your own project (and doing it) if you see a business need for it. Make sure you get approval to do it, of course.

Be a positive force at work:

This should be obvious, but always maintain a positive persona at work. Don’t gossip – you may think that no one knows you are doing it, but they do. You gain a reputation (and it’s not the kind of reputation you want).

Instead, build a reputation as someone who is upbeat, easy to work with, but most of all, is just superb at their job.

Maximizing Your Income

Now that you have stabilized your income by becoming a superstar at work, it’s time to focus on increasing your income either at your current job or by moving to a new job that pays more.

Remember our discussion on expanding your skills earlier? That’s the key to this.

If you have been steadily expanding your skills, your boss (and others) should be noticing by now. Don’t be afraid to let your boss know that you are interested in a promotion or a better role. If you don’t plant the seed, they may not know this is something you are interested in.

If your boss has been around the block a bit, they probably know that there are a lot of people who are happy to stay where they are and don’t want to move higher. These people may not like the extra work or stress that goes along with moving up the chain. They may not like managing people.

Show your boss that this is not you. Let them know that you want to move higher and that you are willing to do what it takes to get there. Come up with a plan (that you and your boss agree on) to move you in that direction.

Then just execute – and do it beyond your boss’ expectations. It’s going to be hard for them to back out of the promotion if you fulfilled a plan that both of you agreed on.

But don’t worry if they do. You haven’t wasted your time. Quite the opposite. You expanded your role massively and you can now showcase that on your resume.

You can describe your role when you started out and highlight how you have progressed into your current role, which is much larger. And if you knocked it out of the park like I suggested, you can show how effective you were in the expanded role.

Employers love seeing a pattern of success and you now have it.

Multiple Income Streams

Ok – you are well on your way to a great career. It might be time to diversify your income.

Why?

Well for one, according to an IRS study, millionaires can have up to seven different streams of income. They must know something.

All kidding aside, there are many reasons to do this and I discuss them in my article on the topic.

But the main reasons are protecting yourself if you lose your job, diversifying your risk overall, and elevating your earning potential.

I started getting multiple income streams by investing in real estate (namely, rental properties). It was a life changing decision. It put me on a completely different financial path. I now own nine rental properties. I did this while I was working a very demanding full-time job.

Now, I have expanded my streams of income to include real estate, dividend paying investments, and an online business. This took years and I wasn’t always gung-ho about it, but I kept plodding along. Turns out that when you persevere, good things happen.

If you are interested in rental property investing, I have a ton of articles that cover a wide range of real estate investing topics. But if you want a great roadmap to help you begin, I would recommend my step-by-step guide to get started investing in real estate.

If real estate investing is not for you, we also have a series devoted to starting a side business, or finding passive income streams. They both cover a lot of other options for you to consider.

Bottom line: start looking to expand your income sources. That one decision could change your life.

Pillar Five: Grow Your Assets

The fifth pillar of personal finance is growing your assets.

Assets and Net Worth

What is an asset? An asset is anything you own that has monetary value.

It can include cash, stocks, bonds, real estate, cars, personal property, and even less tangible items like intellectual property (patents, copyrights, etc.).

Managing your assets is important because your assets determine how wealthy you are. It is literally half of that equation.

Net worth is the standard measure of one’s wealth. It is assets minus liabilities (or debt in simpler terms). If you can grow your assets, while keeping your liabilities in check (or even reducing them, like we showed you earlier), then your wealth will grow.

How Do We Grow Our Assets?

There are two ways to grow your assets. Saving and investing.

Saving:

The first step is to start saving. Now I am assuming you have eliminated your

high interest debt. If not, do that first.

The simplest way to start saving is by opening a savings account, but I would use a high yield savings account so you can get a better return.

CIT Bank is an option that you may want to explore. They offer one of the leading high yield savings products on the market, are FDIC-insured, and they make it easy to open an account. If interested, check them out below.

Ok, so you have your high yield savings account. Now what?

Set Up Emergency Fund

Many financial experts say you should have an emergency fund equal to 3 to 6 months of expenses. They also say that you should put that money into a checking or savings account because you want to be able to access that money freely.

I agree that an emergency fund is a good idea. I disagree that you should have it in your standard checking or savings account – there are better options. Here’s my article explaining what they are and why they are better.

After you have accumulated an emergency fund, you should start to invest in tax advantaged vehicles (many may be offered by your employer).

Grow Your Tax-Advantaged Assets

Your 401(k) is the most obvious choice to grow tax-advantaged assets for retirement. If your employer offers a match, you should definitely prioritize investing in your 401(k) (at least enough to get the full match from your employer).

But there are other benefits that can help you build your assets, including the Health Savings Account, and Employee Stock Purchase Plan.

Not every employer offers these benefits, but if you have access to them, you should check out my articles on how to maximize them. The HSA, in particular is a little-known gem that is one of my favorite tax-advantaged accounts. You can even use it to invest in real estate!

But what if you are not working for a company that offers these benefits? You can still grow your tax-advantaged assets by investing in an Individual Retirement Account (either a Roth version or a traditional version).

Grow Your Taxable Assets

And if you have maxed out your tax-advantaged accounts, you can dip your toe into regular old investing. You just open up a brokerage account and start looking into potential investments.

If you’re not sure what to invest in, this article talks about some basic approaches to asset allocation. Asset allocation is just a fancy way of saying how you should divide up your money into different types of investments, like stocks, bonds, etc. Although the article discusses asset allocation more in the 401(k) context, the info can be applied more generally and can help you get started.

If you are a beginner, I would probably lean toward highly diversified assets, like mutual funds and ETFs that contain stock, and bonds, and potentially other non-correlated assets. These types of diversified portfolios generally carry less risk and volatility.

If you want a ready make solution, you may want to work with a robo-advisor to help you invest your money. Check out Titan. They were voted the top robo-advisor of 2020. You can learn more about them below:

Let’s Not Forget Real Estate Investing

Last, but certainly not least, I have to mention real estate (particularly rental properties). As I discussed in the previous chapter, rental properties can be a great source of additional income, but they can be a fantastic way to grow your assets.

They can appreciate in value, you can use leverage to magnify their returns, and they offer significant tax advantages that preserve your wealth. If you want to learn more about the advantages of rental property investing, check out my article on the topic.

Ok – so that’s a pretty good start on managing your assets. Of course, there are a million ways to invest and grow your assets, but I hope this provides a roadmap for researching any areas that have ignited your interest.

Conclusion

We have covered the five pillars of personal finance and you should now be better equipped to handle your spending, debt, income and assets.

But as I mentioned near the beginning, information is only the first part of the equation. You now need to put these strategies into action. I know it can be done. Many have done it before you.

All it takes is commitment and a desire to improve your financial life. You have already taken the first step by educating yourself on how to better manage your money.

All you need to do is make the decision to activate these strategies in your life. If you do, they will serve as an amazing springboard to a brighter financial future.